A tariff loophole that allowed cheap Chinese goods to enter the United States duty free was eliminated on Friday.

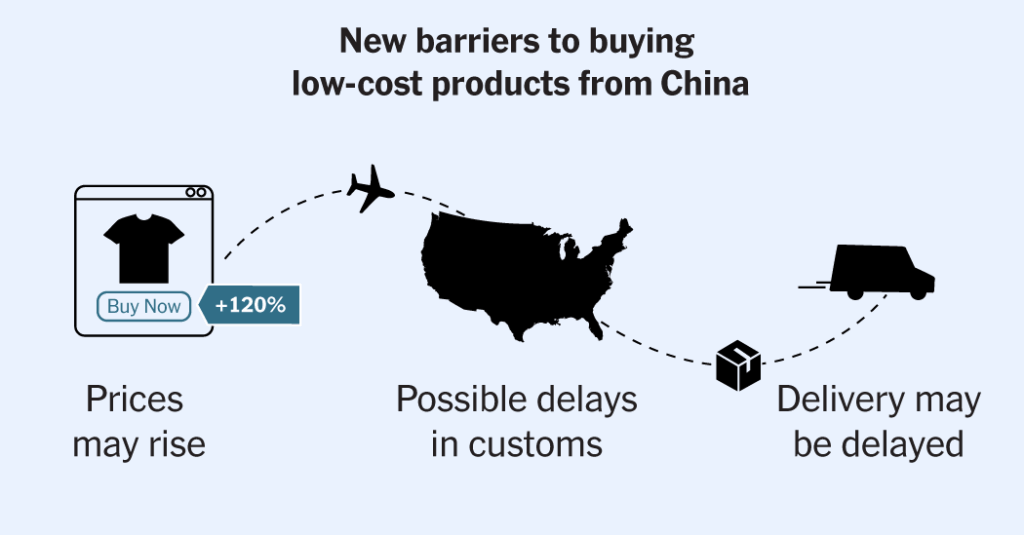

The result could be immediate and costly: T-shirts, stationery and other low-price products on popular e-commerce sites and elsewhere could shoot up in price as shipping carriers and sellers factor in new import taxes. Packages could be delayed, too, as processing goods becomes much more intensive for customs officials.

Ultimately, carriers are responsible for paying the tariff, but here’s how you may be affected:

The elimination of the loophole, known as de minimis, is the latest move by President Trump as he implements aggressive trade policies, particularly toward China.

Before, packages worth up to $800 were exempted from tariffs when they arrived at the U.S. border. (This exemption remains in place for any packages that do not originate from China or Hong Kong.) The rationale had long been that when import taxes are small, or de minimis, customs agents should not bother collecting them. And over time, the value of packages that were exempted continued to increase.

That led to a boom in the number of these de minimis shipments entering the country over the past decade, excluding the disruption from the Covid-19 pandemic. Last year, the number reached more than 1.3 billion, customs data shows, roughly the equivalent of 40 packages entering the United States every second.

Most of them were from China.

The timing coincided with the e-commerce boom, and Chinese companies like Temu and Shein were able to flood the United States with inexpensive goods. China is proficient at low-cost manufacturing, so the products were already cheap — and not subject to tariffs. As a result, American consumers paid super-low prices.

Dozens of countries around the world have de minimis provisions. But few have allowed such a big opening for tariff-free imports, a point critics have cited. The Trump administration has said the provision needed to be tightened because it allowed cheap imports that hurt American businesses. President Trump, in his order closing the loophole for China, said it enabled fentanyl smuggling.

Here’s a breakdown of the levels set by other governments around the world:

How did we get here? It started almost 90 years ago, when Congress enacted the de minimus exemption, declaring that in the name of efficiency, goods worth less than $1 would not be subject to import taxes.

It remains to be seen how the change will play out. Supply chains and shipping are complex, and the added processing may not necessarily mean consumers pay higher costs. Mr. Trump initially wanted to eliminate the de minimis loophole in February but delayed the plan when packages piled up at U.S. airports.