In Summary

- Africa boasts a significant amount of domestic capital, estimated at over $1.1 trillion, which could be leveraged for development.

- The African Development Bank made a record $11 billion in new investments for 2024-2025, demonstrating a growing commitment to development.

- DFIs are increasingly aligning their investments with the Sustainable Development Goals (SDGs), aiming to improve access to healthcare and clean water and create jobs.

Deep Dive!!

As Africa intensifies efforts to bridge its infrastructure gap, boost industrialization, and expand access to sustainable finance, Development Finance Institutions (DFIs) play an increasingly central role in shaping the continent’s economic transformation. These institutions, ranging from regional multilateral banks to sector-specific agencies, offer catalytic funding, technical assistance, and strategic partnerships to accelerate inclusive growth.

According to reports, Africa holds substantial domestic capital, estimated at over $1.1 trillion, including pension funds, insurance funds, and sovereign wealth funds. This represents a significant opportunity to finance development projects and reduce reliance on external financing.

It is important to note that while DFIs play a vital role, they face challenges such as the need to increase the efficiency of public spending and ensure that Africa’s capital is managed prudently and equitably. However, there are also significant opportunities to leverage domestic capital and strengthen institutions for sustainable development.

Here are the Top 10 Development Finance Institutions in Africa in 2025, examining their financial strength, governance structures, and flagship projects that are reshaping sectors from energy and housing to trade and industrial development across the continent.

10. West African Development Bank (BOAD)

West African Economic and Monetary Union (WAEMU) plays a pivotal role in driving regional development by actively financing transformative energy and transport infrastructure projects. Its robust infrastructure portfolio includes the construction of over 3,500 kilometers of cross-border power transmission lines, significantly enhancing energy connectivity across member states. Demonstrating its strong commitment to sustainability, the institution successfully issued €750 million in sustainability bonds at record-low interest rates, channeling these resources into impactful green projects. Notably, it is on track to fund the completion of 30 MW solar power plants in Senegal by 2025, reinforcing its leadership in advancing clean energy solutions across the region.

9. Tanzania Investment Bank (TIB Development Bank)

TIB Development Bank is Tanzania’s first state-owned development finance institution (DFI), it is a strategic vehicle for advancing national economic growth through targeted investments in finance, trade, and SME development. With total assets valued at approximately US $158 million and a post-tax profit of around US $2.3 million in 2023, the institution has steadily positioned itself as a catalyst for inclusive development. Its service portfolio includes export and import credit facilities, equity partnerships, and tailored capacity-building programs designed to empower local enterprises and enhance Tanzania’s competitiveness in regional and global markets.

8. Shelter Afrique

Established in 1982, this housing-focused pan-African development finance institution (DFI) plays a pivotal role in addressing the continent’s urbanization challenges through affordable housing and infrastructure development. With a current portfolio valued at approximately US $224 million, the institution actively collaborates with leading global partners including the Agence Française de Développement (AFD), the European Investment Bank (EIB), the Government of Canada, and UN‑Habitat. Together, they deliver innovative commercial real estate solutions that promote sustainable urban growth and improve living standards across Africa.

7. ECOWAS Bank for Investment and Development (EBID)

As a leading regional development finance institution serving West Africa, this DFI plays a vital role in financing both public and private sector projects that drive regional integration and socio-economic development. Its investment portfolio spans critical sectors such as energy, water, health, and transportation, addressing foundational infrastructure gaps across the region. Notably, it has been a founding investor in transformative ventures like Ecobank and ASKY Airlines, underscoring its commitment to fostering regional connectivity and financial inclusion. Through long-term credit structures and strategic partnerships, the institution continues to champion sustainable growth and cross-border collaboration within the West African sub-region.

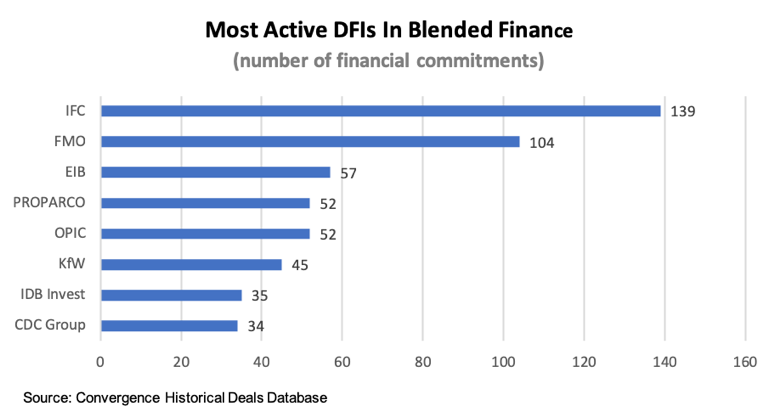

6. Proparco

An affiliate of the French Development Agency (AFD), this institution is a key player in Africa’s development landscape, specializing in financing small and medium-sized enterprises (SMEs), infrastructure projects, and private equity. Through its flagship Choose Africa initiative, it has managed over €2.5 billion in support of African SMEs, catalyzing entrepreneurship and job creation across the continent. During the COVID‑19 pandemic, the institution demonstrated its adaptability and commitment by mobilizing an additional €1 billion in resilience funding to help businesses withstand economic shocks. Its strategic blend of capital investment and technical support continues to drive inclusive and sustainable economic growth across Africa.

5. Development Bank of Southern Africa (DBSA)

As South Africa’s leading development finance institution, this DFI is a driving force behind regional integration and the expansion of renewable energy infrastructure across the continent. It has played a pivotal role in strategic projects such as the rehabilitation of key port infrastructure in Angola and the development of three utility-scale solar power plants in South Africa with a combined capacity of 258 MW. Demonstrating its leadership in global development finance, the institution co-hosted the 2025 Finance in Common Summit alongside the Asian Infrastructure Investment Bank (AIIB) in Cape Town, reinforcing its commitment to sustainable investment, climate resilience, and cross-border collaboration throughout Africa.

4. Africa Finance Corporation (AFC)

As a leading pan-African development finance institution, this DFI is at the forefront of advancing infrastructure and industrial growth across the continent. With a strategic focus on high-impact sectors, it has committed $300 million to transformative projects, including Nigeria’s Dangote refinery and fertilizer complex, as well as major bauxite mining operations in Guinea—catalyzing regional value chains and industrial self-sufficiency. Its innovative capital mobilization approach combines conventional and sustainable finance instruments, exemplified by the issuance of a CHF 150 million green bond and the securing of subordinated Tier-2 funding through the U.S. International Development Finance Corporation (DFC), reflecting a robust blend of financial agility and environmental responsibility.

3. Trade and Development Bank (TDB)

Headquartered in both Burundi and Mauritius, this billion-dollar multilateral development finance institution serves as a vital engine for economic integration and infrastructure development across COMESA and beyond. Structured as a treaty-based entity, it operates under a robust governance framework composed of a shareholders’ Board and an Executive Board of Directors, representing a diverse coalition of member states. With a clear mandate to facilitate regional trade and finance, the institution plays a critical role in unlocking cross-border investment and connectivity. Its expansive footprint, supported by strategically located offices across Eastern and Southern Africa, ensures localized expertise and impact-driven financing for infrastructure and development projects that bolster regional resilience and prosperity.

2. African Export-Import Bank (Afreximbank)

As a pan-African trade finance powerhouse, this institution has evolved from its original mandate into a comprehensive provider of sovereign lending solutions, positioning itself at the heart of Africa’s economic transformation. With strategic subsidiaries such as FEDA (Fund for Export Development in Africa) and AfrexInsure, it offers a holistic suite of trade, investment, and risk mitigation services. Emphasizing its “preferred creditor” status, the institution actively engages with global credit rating agencies to reshape narratives around African debt sustainability. It is also a key sponsor of the Intra-African Trade Fair, a flagship platform of the AfCFTA, and supports value creation through initiatives like CANEX, which funds creative industries and quality-control infrastructure. Its most recent milestone, the launch of the African Energy Bank—marks a bold step toward energy self-reliance and on-continent investment in oil and gas projects.

1. African Development Bank (AfDB)

The African Development Bank (AfDB) stands as the continent’s premier multilateral development finance institution, jointly owned by 54 African and non-African nations and backed by an impressive $318 billion capital base. As of September 2025, Sidi Ould Tah is set to assume leadership, steering the Bank through a complex landscape of funding constraints and global macroeconomic challenges. Renowned for its adherence to international financial standards, AfDB has recently pioneered innovative financing tools, including hybrid capital instruments, and earned recognition as “DFI of the Year” at the TXF Global Awards. Its portfolio includes transformative infrastructure and climate initiatives such as the Sahel Desert-to-Power project and the African Green Bank, reflecting its unwavering commitment to sustainable development. With a groundbreaking $750 million hybrid bond mobilized for climate finance and the launch of the African Financial Stability Mechanism, the AfDB continues to be a central force in driving inclusive growth and economic resilience across the continent.