In Summary

- The African remittances market is projected to reach a total transaction value of $75.72 billion by the end of 2025.

- Africa’s most populous country, Nigeria, is expected to receive the largest share of remittance, with diaspora remittances projected to hit $26 billion.

- The Annual Growth Rate (CAGR) of remittance is projected to be 9.96% between 2025 and 2030, leading to a total of $121.73 billion by 2030.

- The World Bank estimates that remittances to Africa could reach $500 billion by 2035 if transfer costs are reduced.

Deep Dive!!

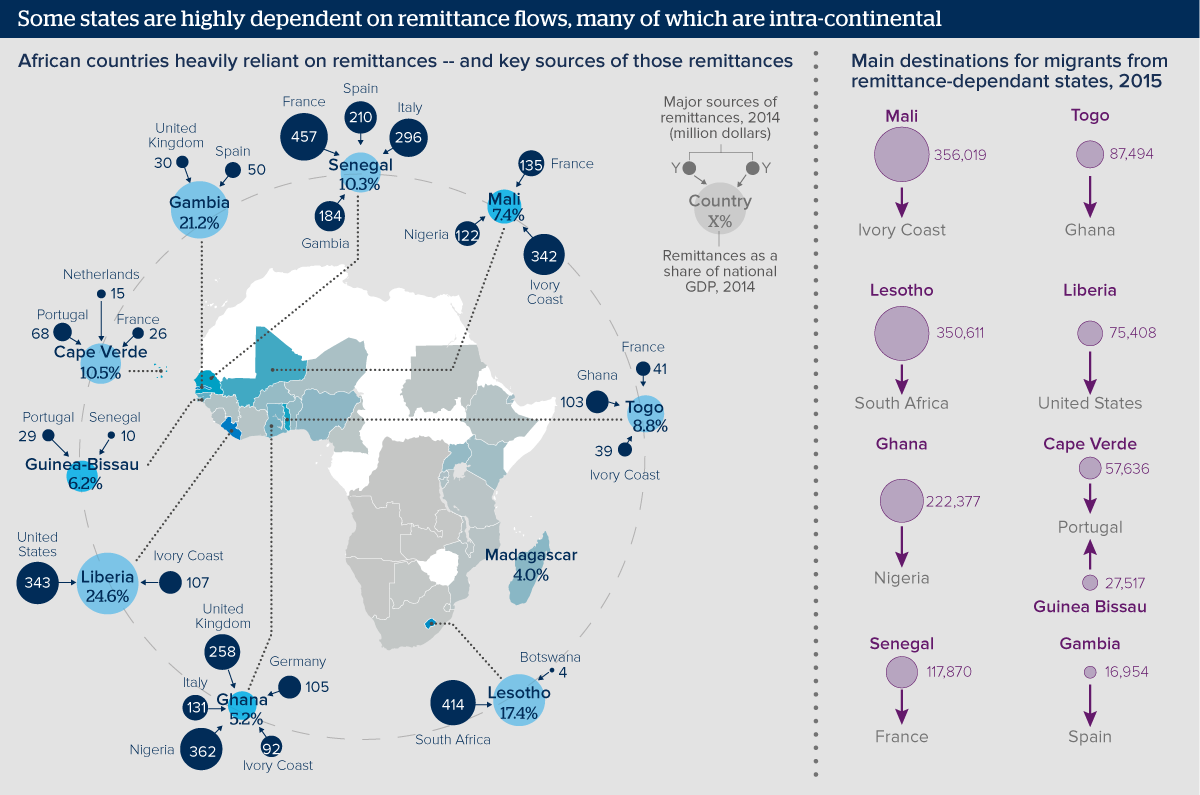

Remittance refers to the money individuals send to their home country from abroad. Over time, it has emerged as a powerful force shaping the economic landscape of many African nations. As millions of Africans live and work abroad, the financial support they send back home has become a vital source of foreign exchange, household income, and national development funding.

Noticing the significant impact that inflows from diaspora communities have contributed to developing countries, more African nations have continued to implement policies to facilitate and optimize these inflows, making remittances a critical component of Africa’s economic landscape.

Here are the Top 10 African countries with the largest remittance inflows in 2025, highlighting their economic significance, the policies driving growth, and how these funds are transforming lives and economies across the continent. From Egypt to the Democratic Republic of Congo, we delve into how the African diaspora is not only maintaining ties with their homelands but also fueling long-term prosperity.

10. Democratic Republic of Congo – $1.4 Billion

The Democratic Republic of Congo’s remittance inflows totaled $1.4 billion in 2024. While this represents a decline from previous years, remittances remain a vital source of income for many households, contributing to poverty alleviation and economic resilience.

9. Algeria – $1.86 Billion

Algeria received $1.86 billion in remittances in 2024, reflecting the ongoing support from its diaspora. Remittances play a crucial role in sustaining household incomes and supporting the national economy, particularly in times of economic uncertainty.

8. Tunisia – $2.8 Billion

Tunisia’s remittance inflows reached $2.8 billion in 2024, ranking it sixth among Arab countries. These funds are vital for supporting household consumption and contribute significantly to the country’s foreign exchange reserves.

7. Senegal – $2.94 Billion

Senegal received $2.94 billion in remittances in 2024, which constituted about 11% of its GDP. The government is promoting the productive use of remittances by encouraging investments in sectors like agriculture and tourism. Initiatives such as the establishment of a “diaspora bank” aim to channel funds into projects that generate employment and stimulate economic growth.

6. Zimbabwe – $3.08 Billion

Zimbabwe’s diaspora sent home $3.08 billion in 2024, providing critical support amid economic challenges. Remittances are a lifeline for many households, funding basic needs and small business ventures. The Zimbabwean government has recognized the importance of these inflows and is exploring policies to facilitate and maximize their impact.

5. Ghana – $4.6 Billion

Ghana received $4.6 billion in remittances in 2024, underscoring the significant role of its diaspora in supporting the national economy. These funds are essential for household consumption, education, and healthcare, and they contribute to poverty reduction and economic stability.

4. Kenya – $4.94 Billion

Kenya saw a record $4.94 billion in remittances in 2024, marking an 18% increase from the previous year. The United States remained the largest source, contributing 51% of total inflows. The Kenyan government has actively encouraged labor migration, with President William Ruto promoting opportunities abroad to address domestic unemployment. Remittances have become Kenya’s largest source of foreign exchange, surpassing tourism and agricultural exports.

3. Morocco – $12.05 Billion

Morocco’s diaspora contributed $12.05 billion in remittances in 2024, reflecting the strong ties between Moroccans abroad and their homeland. These funds play a crucial role in supporting household incomes, education, and healthcare, as well as stimulating economic growth through increased consumption and investment.

2. Nigeria – $19.8 Billion

Nigeria received $19.8 billion in remittances in 2024, accounting for approximately 35% of Sub-Saharan Africa’s total inflows. The Central Bank of Nigeria has implemented policies to enhance remittance flows, including the consideration of issuing a diaspora bond in the United States and aiming for $1 billion in monthly remittances. These efforts have bolstered foreign reserves and investor confidence, contributing to economic diversification.

1. Egypt – $22.7 Billion

Egypt maintained its position as Africa’s leading recipient of remittances in 2024, with inflows reaching $22.7 billion. This significant increase was driven by economic reforms, including the liberalization of exchange rates and higher interest rates on savings instruments, which encouraged Egyptians abroad to utilize formal banking channels. With an estimated 14 million Egyptians living overseas, remittances have become a vital source of foreign currency, supporting household consumption and national development.