MASSAGE SEATS

Chinese consumers place more value on interior comfort compared to other markets, according to European carmakers.

Visitors at Auto Shanghai queued to sit in luxurious minivans with chrome radiator grilles and reclining rear seats.

Mercedes unveiled a prototype of its next-generation luxury electric minivan, the Vision V, hoping to seduce future executives with aluminum seats, wood and silk trim, and a cinema screen that folds out from the floor.

According to McKinsey, lifestyle-oriented features such as fridges, televisions and reclining seats are highly sought after in China, as are top-spec suspension and rear-wheel steering that enhance comfort while driving.

“As vehicle prices increase, so does consumer demand for these features, along with a growing willingness to pay extra” to have them, the consultancy said.

On Friday, Chinese carmaker Nio had passengers bounce around inside its vehicles to demonstrate the effectiveness of the suspension.

Others are turning to traditional techniques, with French equipment manufacturer Forvia offering a seat that kneads, pinches, and pricks its occupant.

The seat was “inspired by traditional Chinese and Thai massages”, said innovation manager Zong Li at the company’s booth, and is expected to be installed in a Chinese vehicle this year.

DRONES

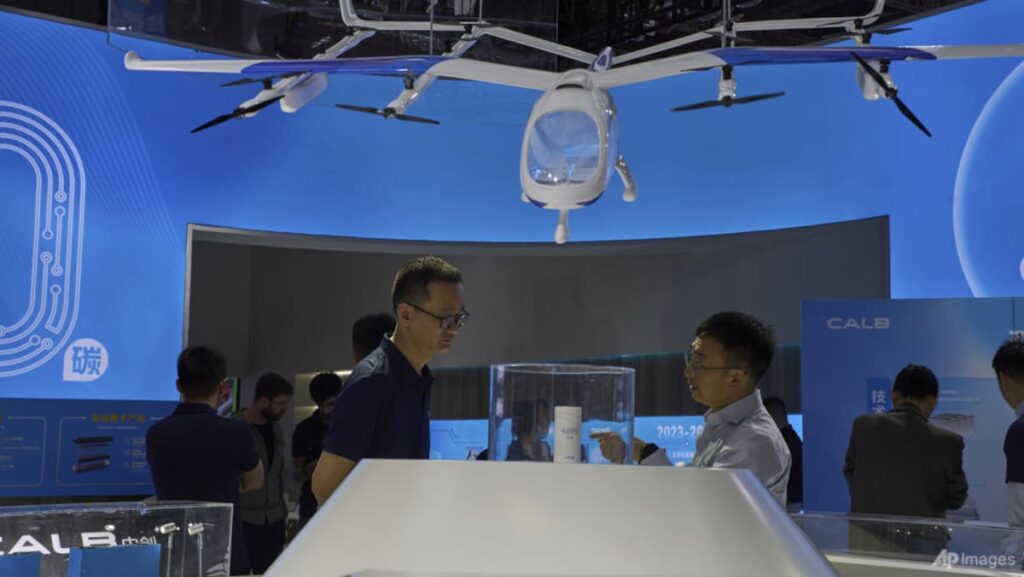

Elsewhere, a number of propeller-powered flying taxis towered over other vehicles.

The technology, known as electric vertical take-off and landing (eVTOL), is still at the prototype stage but eventually aims to ferry several people at a time.

The world’s leading battery manufacturer, CATL, showed off its eVTOL concept, fresh from announcing an investment of “hundreds of millions of dollars” in Chinese startup AutoFlight.

Even traditional manufacturer Hongqi – famous for supplying limousines to China’s leader Xi Jinping – presented its concept of a “flying car” for two passengers, claiming an unproven range of 200km ahead of tests scheduled this year.

In recent years, China has made strides in eVTOL technology, where it is in direct competition with US players while Europeans struggle to make their mark.

Automotive supplier Wanfeng announced last month that it would take over bankrupt German eVTOL manufacturer Volocopter, whose aircraft were originally slated for a small-scale rollout during the 2024 Paris Olympics but are still awaiting certification.