Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

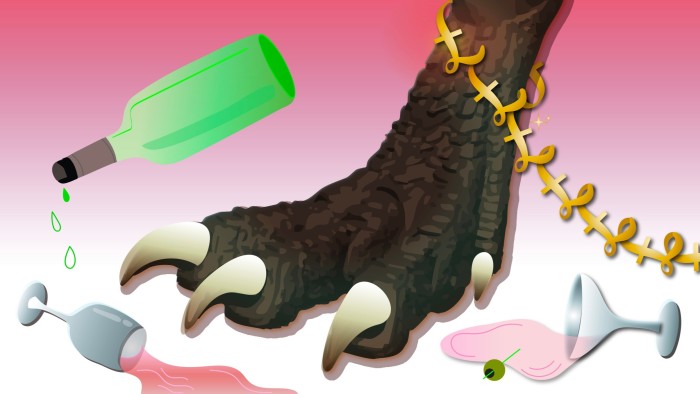

A few weeks ago, a British government official privately joked to me that London’s markets have become “chained to a drunken dragon”.

The reason? Gilt yields used to move (mostly) in response to British fundamentals. But Bank of England research suggests these are increasingly being knocked about by US government bond prices.

That is ironic, given how keen the British government — like the rest of Europe — is to exert economic sovereignty and ringfence the UK from America. It is also dangerous: prices in the once boring Treasuries market are now thrashing around wildly in response to President Donald Trump’s capricious policy plans.

So the question for nervous investors and officials, in London and elsewhere, is this: will this Treasuries “dragon” sober up in the coming months? Or will it just keep bashing everyone around?

At first glance, there is scant reason for optimism.

This week the IMF warned that “global financial stability risks have increased significantly” due to a nasty mix of US policy uncertainty, geopolitical risk, rising sovereign debt burdens and excess leverage in some corners of finance. One particularly notable risk is that highly levered hedge funds have made so-called basis trade bets with US bonds — and are now unwinding this, pushing yields around.

Worse still, the US Congress is trying to implement massive tax cuts just as Trump’s tariffs are threatening to tip America into recession. Jan Hatzius, chief economist at Goldman Sachs, is warning that “the dollar has further to fall”. This is a nasty cocktail for Treasuries, even without the unpredictable dramas around Trump.

However, if investors want to cheer themselves up, they should note two other points. The first is that Scott Bessent, US Treasury secretary, seems increasingly influential in Trump’s quasi-imperial court. Indeed, reports suggest that he not only clashed explosively with Elon Musk recently in a dispute over the Internal Revenue Service, but won.

That is encouraging. If anyone in Trump’s orbit understands market discipline, it should be Bessent, given that he worked at George Soros’s hedge fund when it famously “broke the pound” back in 1992 by betting that economic fundamentals would force the British government to abandon the sterling currency peg.

Bessent is, in other words, a financial poacher turned gamekeeper, who respects bond vigilantes. His is a very different background to that of Howard Lutnick, commerce secretary, who built his career as a broker, skilfully flattering clients (now just Trump).

Better still, there is mounting evidence that those bond market vigilantes are forcing Trump to blink — a bit. When Treasury yields surged earlier this month, Bessent (and Trump) verbally softened their wilder tariff threats. So too when yields soared again after Trump threatened to remove Jay Powell as chair of the Federal Reserve.

That leaves Nouriel Roubini, the economist, telling his clients that “traders 1745648617 trump Trump”. Or, to put it another way, there now seems to be a bond market “put”, or a level of price swings that will force the White House to modify policy, at least verbally — probably around 4.5 per cent for 10-year yields.

In addition to this, Bessent is clearly hunting for technical tricks he can find to maintain calm. One would be to accelerate a programme to purchase illiquid long-dated Treasuries, and replace these with the type of liquid bonds that foreign investors like. “We could up the buybacks if we wanted,” he recently said. “We have a big toolkit that we can roll out.”

Another would be to reverse the rules introduced after the 2008 great financial crisis that made it expensive for banks to act as market makers. Financiers such as Jamie Dimon, head of JPMorgan, argue that these rules curbed liquidity in a way that raised price volatility.

Some economists contest that. But if Bessent rolls back the so-called liquidity coverage ratio rules as part of a bigger regulatory reset — which he has promised — Wall Street will cheer.

There are other, far wilder, ideas floating around: using the Treasury’s stock of gold to back bonds; forcing military allies, such as Japan, to buy more US debt; encouraging the global use of Treasuries-backed stablecoins. Such concepts may never fly. But they cannot be totally discounted.

Of course, a cynic might say this is merely putting lipstick on a financial pig. Fair enough: no amount of “tricks” — or “puts” — will stop US yields from surging if America’s fiscal fundamentals keep deteriorating, inflation expectations soar and/or Trump remains capricious. All seem probable.

But right now the key point is this: in Bessent, there is a dragon tamer, of sorts, in the White House, clinging on to the beast’s tail. Let us hope that Musk does not push him out. If he does, investors in New York and London alike will really start to panic.

gillian.tett@ft.com