In Summary

- The African capital market has a market capitalization of about $2 trillion, representing more than 60% of the continent’s $3.1 trillion GDP.

- As of 2025, Africa hosts over thirty stock exchanges, with 1,100 companies listed in the stock exchange market.

- Africa’s equity markets account for less than 10% of annual capital flows, which include foreign direct investment and remittances, on the continent.

Deep Dive!!

Development Finance Institutions (DFIs) have long played a catalytic role in shaping Africa’s economic trajectory. As the continent grapples with deepening climate vulnerabilities, infrastructure gaps, and youth unemployment, DFIs are evolving beyond traditional mandates.

According to reports, the African capital market has a market capitalization of about $2 trillion, representing more than 60% of the continent’s $3.1 trillion GDP. While this may seem impressive, it is less than 2% of the global capital market. Despite the continent hosting over thirty stock exchanges, with 1,100 companies actively listed, many African capital markets are underdeveloped and shallow, with few listed securities and financial products, limiting their ability to mobilize and intermediate financing for sustainable economic growth.

On the bright side, experts have observed a dynamic transformation in how these institutions interact with capital markets, moving toward more blended, inclusive, and sustainable financing mechanisms. The African capital market has significant growth potential, and well-developed capital markets are a driver of economic growth.

In this article, we explore the top 10 impactful initiatives currently redefining the roles of DFIs in Africa’s capital markets, based on policy analysis, financial data, institutional reports, and market performance indicators.

Here are the Top 10 Initiatives Shaping Development Finance Institutions in Africa’s Capital Markets in 2025. Check them out!

- Blended Finance Structures for Infrastructure Development

DFIs such as the African Development Bank (AfDB), Trade and Development Bank (TDB), and Africa50 are increasingly deploying blended finance models, combining concessional capital with commercial funds to de-risk large-scale infrastructure projects. According to Convergence (2024), over $4.8 billion in blended finance was deployed across Africa in 2023 alone. The AfDB’s Africa Investment Forum has become a central platform, facilitating deals worth $63 billion since its inception. These structures are drawing in pension funds, sovereign wealth funds, and private equity into traditionally “unbankable” projects. - Launch of Green and Blue Bonds

Climate-resilient finance is taking center stage. African DFIs are pioneering green and blue bonds to finance renewable energy, sustainable agriculture, and coastal resilience. The Nigerian Sovereign Green Bond, first launched in 2017, now has a second tranche oversubscribed by 240% in 2024. The Blue Economy Financing Initiative, co-led by DBSA and IFC, has channeled $350 million toward marine biodiversity and aquaculture through capital markets. These instruments align with ESG metrics and attract impact investors seeking long-term value. - Deepening Regional Capital Market Integration

Fragmented national markets limit scale and liquidity. DFIs are investing in regional harmonization efforts: The African Exchanges Linkage Project (AELP), supported by Afreximbank and UNECA, is integrating trading platforms across 7 African stock exchanges. Combined, these markets represent a capitalization of over $1.5 trillion as of Q1 2025, up from $1.2 trillion in 2022. This integration improves cross-border investment flows, enhances transparency, and reduces transaction costs. - Launch of the African Credit Rating Agency (AfCRA)

One critical barrier to capital market growth in Africa is limited and biased sovereign and corporate ratings. The AfCRA, launched in late 2023 with support from the AfDB and AU, aims to provide more context-sensitive, African-led ratings. Within its first year, AfCRA rated 34 African entities, contributing to a 14% increase in bond issuances by regional banks and corporates. By improving perceived creditworthiness, this initiative unlocks new capital sources for African issuers. - Tech-Enabled Capital Mobilization Platforms

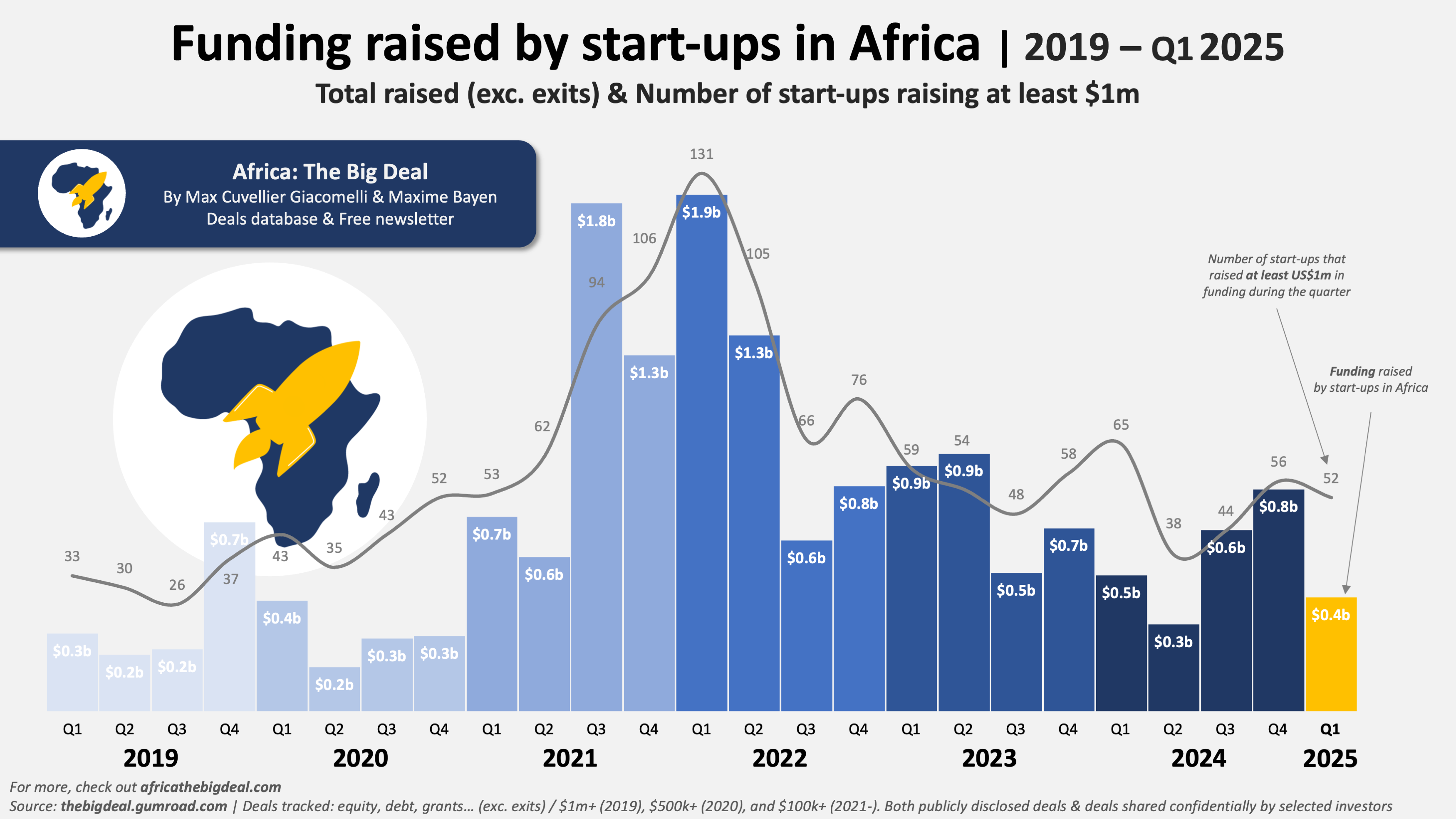

DFIs are supporting fintech platforms that democratize access to investment and savings. For instance, the DigiCapital initiative by East African DFIs enables retail bond subscriptions via mobile phones. Over 2 million users have accessed capital market instruments through these platforms in Kenya, Nigeria, and Ghana since 2022. These platforms not only mobilize domestic capital but also enhance financial inclusion. - Anchor Investments in Impact Funds and Venture Capital

To address Africa’s innovation financing gap, DFIs are increasingly seeding impact funds and early-stage venture vehicles. AfDB’s Boost Africa program has invested in 23 VC funds, catalyzing over $900 million in startup capital. The EIB, through its ACP Investment Facility, has deployed €450 million into African climate and tech-focused funds since 2021. These investments de-risk innovation and crowd in private capital. - Strengthening Environmental, Social, and Governance (ESG) Standards

DFIs are not only funding ESG-compliant projects—they’re shaping ESG frameworks. The Africa ESG Disclosure Initiative, backed by the AfDB and national securities commissions, is rolling out ESG disclosure guidelines in 15 countries. Companies adhering to these standards have seen an average of 18% lower capital costs in recent capital raises. This fosters accountability, aligns with global investment trends, and builds investor trust. - Co-guarantee Platforms for Credit Enhancement

To mitigate sovereign and corporate default risk, DFIs are co-creating guarantee mechanisms: The Africa Co-Guarantee Platform, formed by Afreximbank, AfDB, and GuarantCo, provided $2.3 billion in credit guarantees across 2023-2024. This led to a 22% increase in sub-sovereign debt issuance, particularly for municipal infrastructure and healthcare systems. Credit enhancement unlocks long-term local currency financing, a cornerstone for sustainable development. - Mobilizing Diaspora Bonds and Sovereign Wealth

African DFIs are tapping into diaspora capital, estimated at over $95 billion annually in remittances. Ethiopia, Ghana, and Kenya have issued diaspora bonds, many underwritten or structured by DFIs. These instruments offer dual returns—financial and emotional—for diasporans while funding national development. Additionally, partnerships with sovereign wealth funds (e.g., Nigeria’s NSIA) are scaling public-private finance models. - Integration with the African Continental Free Trade Area (AfCFTA)

Perhaps the most transformative initiative is DFIs aligning capital market strategy with the AfCFTA. DFIs like Afreximbank have created the Pan-African Payment and Settlement System (PAPSS) to enable intra-African trade settlements in local currencies. With AfCFTA projected to boost intra-African trade by 52.3% by 2035 (UNECA, 2024), capital market frameworks are being redesigned to support borderless financing. These linkages will allow DFIs to finance supply chains, industrial parks, and trade infrastructure across regions more efficiently.

Conclusion

In 2025, DFIs in Africa are not merely sources of concessional finance—they are architects of resilient, inclusive capital markets. Through innovation, collaboration, and policy leadership, these institutions are redefining development finance and aligning it with the continent’s long-term transformation agenda.

However, the journey is ongoing. Sustaining momentum will require stronger governance, data infrastructure, political will, and continued alignment with global capital markets. If successful, Africa’s DFIs may well become global models of adaptive finance in a rapidly shifting economic landscape.