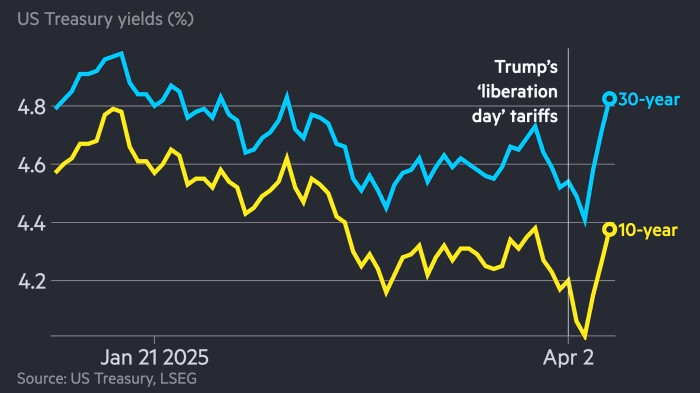

There’s a lot going on in the Treasury market right now, and none of it is good. Liberation Day seems to have morphed into Liquidation Day.

You might have seen terms like “off the runs”, “basis trades”, “swap spreads” and “omg are we going to die” bandied about over the past few days (including here on Alphaville) and been a little baffled.

We realise that not everyone is quite the fixed income dorks that we are, so here’s an explainer of some of the more common “relative-value” strategies that hedge funds often pursue in the bond market.

This is not the really funky stuff. These are actually fairly plain-vanilla trades that have in some form been around for decades. But quite a few of them were supercharged in the post-crisis era — thanks to the regulation-enforced retreat of banks and the rise of leaner algorithmic market-makers — and all have the potential to blow up rarely but spectacularly (viz LTCM).

If you’re a diligent Alphaville reader then some of this might seem familiar, as we’ve in some places repurposed or adapted previous material from older posts. But we thought it might make sense to gather all this stuff in one simple (ish) explainer, and rewriting everything from scratch felt redundant. As always, let us know in the comments if we’ve gotten something wrong in the process of simplifying things.

Treasury basis trades

This is the one that is most often talked about, as it is one of the longest-established fixed income relative-value trades around — dating at least back to 1979, when Salomon Brothers’ John Meriwether lifted one version out of EF Eckstein, one of the first Treasury futures brokers.

Treasury futures typically trade at a premium to the government bond you can deliver to satisfy the derivatives contract. That’s mostly because they are a convenient way for investors to gain leveraged exposure to Treasuries (you only have to put down an initial margin for the nominal exposure you’re buying). Asset managers are as a result mostly net long Treasury futures.

However this premium opens up an opportunity for hedge funds to take the other side. They sell Treasury futures and buy Treasury bonds to hedge themselves, capturing an almost risk-free spread of a few basis points. Normally, hedge fund managers don’t get out of bed for a few measly bps, but because Treasuries are so solid you can leverage the trade many, many times.

Let’s say you put down $10mn for Treasuries and sell an equal value of futures. You can then use the Treasuries as collateral for, say, $9.9mn of short-term loans in the repo market. Then you buy another $9.9mn of Treasuries, sell an equivalent amount of Treasury futures, and the repeat the process again and again and again.

It’s hard to get firm idea of what is the typical amount of leverage that hedge funds use for Treasury basis trades, but Alphaville gathers that as much as 50 times is normal and up to 100 times can happen. In other words, just $10mn of capital can support as much as $1bn of Treasury purchases.

Here’s a good schematic showing how it all works, from a previous big read on the subject:

And how significant is the trade in aggregate? Well, it’s an imperfect measure for a lot of reasons, but the best proxy for its overall size is the net short Treasury futures positioning of hedge funds, which currently stands at about $800bn, with asset managers the mirror image on the long side.

The problem is that both Treasury futures and repo markets demand much more collateral when there is an unusual amount of volatility in the Treasury market. And if the hedge fund can’t pony up then lenders can seize the collateral — Treasury bonds — and sell them into the market. As a result, it is a major danger lurking inside the market that is supposed to be the financial system’s equivalent of a bomb shelter.

We saw this most memorably in March 2020, when it took almost $1tn of Treasury-purchases by the Federal Reserve to prevent the US government bond market from exploding. We are not nearly there right now, but there’s been a similar “doom loop” of margin calls, liquidation and falling prices in recent days.

Off-the-run trades

Another famous Treasury trade also popularised by LTCM takes advantage of how investors in the US government bond market usually pay a premium for the most recently-issued Treasury bond.

That’s because the freshly-minted Treasury — which is called the “on-the-run” security — is the most liquid. After a few weeks or months of issuance, it tends to settle into accounts at insurance companies, banks or pension plans, where it doesn’t trade as much. It becomes an “off-the-run” Treasury bond.

But inevitably, all on-the-run Treasuries become off-the-run Treasuries eventually, so the price difference can be exploited by hedge funds. They short the freshest Treasury bonds and go long the nearest off-the-run one, which might just be a few months older.

Once a new on-the-run bond emerges, the prices between the two securities should converge. Sometimes we’re talking only a couple of basis points of difference between two very similar Treasuries, but here’s a chart showing the yield difference between Treasuries maturing in nine and 10 years to make it clearer.

As you can see, it can be as low as zero, is usually around 4-5 basis points and has now shot up to nearly 9 basis points (and at the time of writing, US trading hasn’t really gotten under way yet).

Like Treasury basis trades, this only works with enormous dollops of leverage. And because both legs of the trade are supersafe US Treasuries (only the maturity is a little different), prime brokerages at banks will allow a lot of it, just as they do with Treasury basis trades.

Of course, just because the spreads should narrow over time doesn’t mean that they always do. In both LTCM’s 1998 death and in March 2020 the spread between off and on the run securities also ballooned dramatically, as the violence of the volatility forced hedge funds to unwind the trade.

As the Federal Reserve’s minutes from March 15, 2020 noted:

In the Treasury market, following several consecutive days of deteriorating conditions, market participants reported an acute decline in market liquidity. A number of primary dealers found it especially difficult to make markets in off-the-run Treasury securities and reported that this segment of the market had ceased to function effectively.

Again, we’re not seeing anywhere near this turbulence right now, but off-the-run spreads have widened, implying that this could be another contributing factor to the Treasury market sell-off.

Swap spread trades

This is a newer culprit, and one that Alphaville initially discounted as a smaller contributor than the basis trade being unwound. But from our conversations it seems it could actually have been the biggest one so far.

Because of various bits of post-financial crisis regulation, US banks are constrained in how many Treasuries they can hold. Meanwhile, cleared interest rate swaps are less capital-intensive, which has led to swap spreads — the difference between the fixed rate bit of an interest rate swap and the comparable government bond yield — to mostly stay in negative territory for many years.

It has been especially prevalent for longer term swaps. In practice, the negative swap spreads simply reflected the rising cost of storing stuff on banks’ balance sheets. As the Bank for International Settlements said in a report last year:

Negative spreads compensate intermediaries for holding government bonds on their balance sheets and entering swaps as fixed rate payers. Both swap and bond markets are intermediated by bank-affiliated dealers who require remuneration for using their balance sheets and taking on associated risks. When dealers absorb a large amount of bonds, they incur funding costs in the repo market for financing the long bond position.

Additionally, they tend to hedge the interest rate risk by paying the fixed swap rate and receiving the floating rate. When doing so, dealers also need to factor in balance sheet costs from internal risk management and prudential rules, as well as opportunity costs of other uses of their balance sheet capacity.

If these costs are high enough, dealers will recoup them through a negative swap spread. Moreover, if dealer balance sheets are constrained, non-bank players such as hedge funds may need to be incentivised to step in, deploying repo leverage to assume similar positions as dealers.

However, at the start of the year, a lot of people were getting excited by the prospect of the new Trump administration unwinding a lot of the post-crisis regulatory edifice.

And that raised the prospect of negative swap rates suddenly evaporating, as banks would be freed up to hold more Treasuries themselves, or simply have much more balance sheet space to finance hedge funds that wanted to arbitrage the spread.

In February, Barclays estimated that the scrapping of the “supplementary leverage ratio” alone could create about $6tn of “leverage exposure capacity”, which would in particular help Treasuries. As a result, hedge funds earlier this year went long Treasuries and short swaps in the expectation that the spread would flip from being deeply negative to closer to zero.

However the convergence trade only works with lots of leverage (you might have detected a theme here). And the recent volatility has ratcheted up margin requirements across the board, unravelling many of these trades.

That has in turn made the swap spread even more negative, and led to new round of margin calls, even more negative swap spreads, and so on.

OK OK that’s enough. So what does it all mean?

Well, that Treasury market volatility triggered by the Trump administration’s new tariff regime has now sparked a technical unwind of billions of dollars of highly leveraged hedge fund trades — a bit like how Liz Truss’s badly-judged budget plans triggered a meltdown of LDI strategies in the gilt market.

All these trades are in their basic form pretty safe, and arguably a service to financial markets, by helping support Treasury markets and ensuring that all the different parts of the wider rates ecosystem is tied together. It’s the level and fickleness of the leverage that can make them dangerous occasionally.

Normally these things burn themselves out soon enough, but there are rising expectations that the Federal Reserve may have to step in to prevent the Treasury sell-off from becoming disorderly and destructive. In other words, not per se to keep yields low, but to ensure that there are no major financial mishaps.

However, at some point we really should stop and think about whether we want the US Treasury market to be so vulnerable to these kinds of situations that it requires central bank intervention again and again?