Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Global equities rose on Monday on signs that consumer electronics imported into the US from China might escape the steepest of Donald Trump’s tariffs, as stock markets regained their footing after the turmoil created last week by the international trade war.

Futures tracking the S&P 500 and the tech-heavy Nasdaq 100 were up more than 1 per cent, after the White House late on Friday excluded smartphones and other consumer electronics from steep tariffs it introduced earlier this month, including the 125 per cent levied on China.

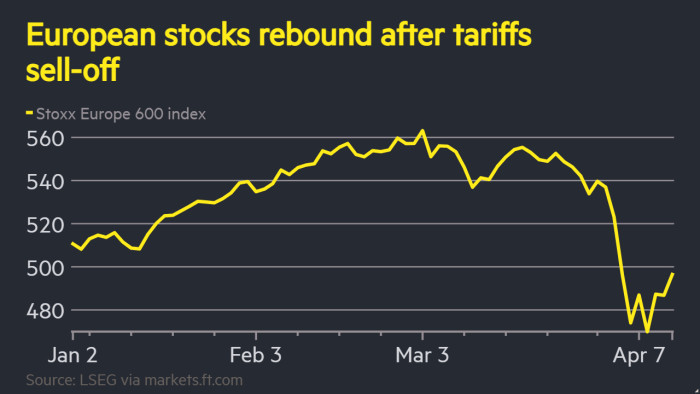

European stocks rose, with the benchmark Stoxx Europe 600 up 2.1 per cent by midday, while the UK’s blue-chip FTSE 100 climbed 1.8 per cent.

Trump and Howard Lutnick, US commerce secretary, on Sunday indicated that consumer electronics would instead be subject to a separate duty the White House was preparing for semiconductors.

It was unclear what level the chips tariffs would be set at, but other duties the Trump administration has imposed on individual sectors such as steel and aluminium suggest they could be substantially lower than the levies currently imposed on China.

“Markets are taking whatever sign of relief they can,” said Mitul Kotecha, head of emerging markets macro strategy at Barclays.

In comments to journalists on Air Force One on Sunday, Trump said his administration would show “flexibility” for some products and signalled that it would be speaking to key companies to discuss the tariffs.

Asked what the semiconductor tariff rate would be, he told reporters he would “be announcing it over the next week”.

Trump’s sweeping tariffs, announced at a “liberation day” event this month, unleashed turmoil across financial markets and sparked fears of a global recession. But stocks rallied at the end of the week, after Trump’s decision to put a 90-day pause on big “reciprocal” tariffs for most countries fed optimism that the worst-case trade scenario could be avoided.

The prospect of lower tariffs on popular consumer electronics would be a boost for Apple and other tech groups that rely heavily on Chinese factories to make iPhones and other goods.

Apple shares jumped almost 5 per cent in pre-market trading.

“We might be past peak tariff fear,” said Michael Metcalfe, head of macro strategy at State Street Global Markets, adding that the new exemptions were a “reasonably significant backing off” on the level of tariffs expected at the end of last week.

In Europe, technology stocks were among the winners, with Dutch chipmakers Besi and ASML up 3.7 per cent and 2.8 per cent respectively.

But in a sign that investors remain concerned about Trump’s chaotic policymaking and the damage tariffs would inflict on the US economy, the dollar extended its drop on Monday.

The dollar was down 0.5 per cent against a basket of major currencies including the yen and the pound, as investors continued to be wary about increasing their exposure to US assets.

Analysts said markets were being caught between signs of capitulation on US tariffs and worries over the damage already done to the global economy.

“Trump is clearly backtracking,” said Luca Paolini, chief strategist at Pictet Asset Management. “Markets smell he is desperate to find a way out of here, but the damage cannot be completely undone.”

The 10-year US Treasury yield, which soared last week as investors took fright over Trump’s escalating tariffs on China, fell 0.06 percentage points to 4.43 per cent as the price of the debt recovered.

Haven assets were steady. Gold touched a fresh record high of $3,245.75 per troy ounce on Monday, before giving up its gains, while the Japanese yen strengthened 0.4 per cent against the dollar to ¥143.

Markets in Asia rebounded, led by Hong Kong’s Hang Seng index up 2.4 per cent, Japan’s Nikkei 225 rising 1.2 per cent and the broad Topix up by 0.9 per cent.

China’s mainland CSI 300 rose 0.2 per cent as official data showed exports from the world’s second-largest economy leapt last month amid a rush to dispatch shipments before tariffs took effect.

Exports rose 12.4 per cent in US dollar terms in March on a year earlier, figures from China’s customs administration showed on Monday, well above expectations and the biggest rise since October.

Imports fell 4.3 per cent, a less steep contraction than the 8.4 per cent fall in the January-February period.