The US dollar slid on Friday as Donald Trump’s erratic tariff regime heightened global economic uncertainty and triggered a flight into gold and other haven assets.

The US dollar index slumped below 100, a key threshold, for the fist time since July 2023 during trading in Asia. The euro rose 0.8 per cent to $1.13 and sterling gained 0.3 per cent to $1.30. The yen strengthened to ¥143.9 per dollar, a six-month high.

“You’ve gone from growth and inflation worries to worries about liquidity and market functioning”, said Mitul Kotecha, head of emerging markets macro strategy at Barclays, who also cited “policy uncertainty” from the US as a reason for the decline in the dollar.

Gold prices hit a record high and the Swiss franc surged as investors moved into haven assets. Bullion prices jumped as much as 1.4 per cent to $3,218 a troy ounce while the Swiss franc climbed as much as 1.2 per cent against the dollar to SFr0.814. It subsequently pared gains to trade around SFr0.82.

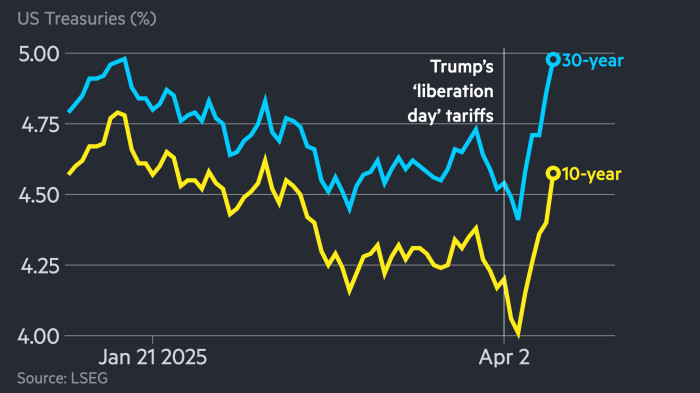

On Thursday the S&P 500 dropped 3.5 per cent and the Nasdaq fell 4.3 per cent while Treasuries sold off on concerns of a US recession and trade war with China. On Friday yields on 10-year Treasuries were flat at 4.42 per cent after rising 0.09 percentage the previous day. Bond yields move inversely to prices.

Asian equities were mixed with Japan’s Topix falling 2.9 per cent while Taiwan and India rose 2.8 per cent and 2.3 per cent, respectively. Hong Kong’s Hang Seng index gained 1.1 per cent and China’s CSI 300 rose 0.3 per cent.